Spectacular Tips About How To Be A California Resident

In determining residency, california law provides two presumptions.

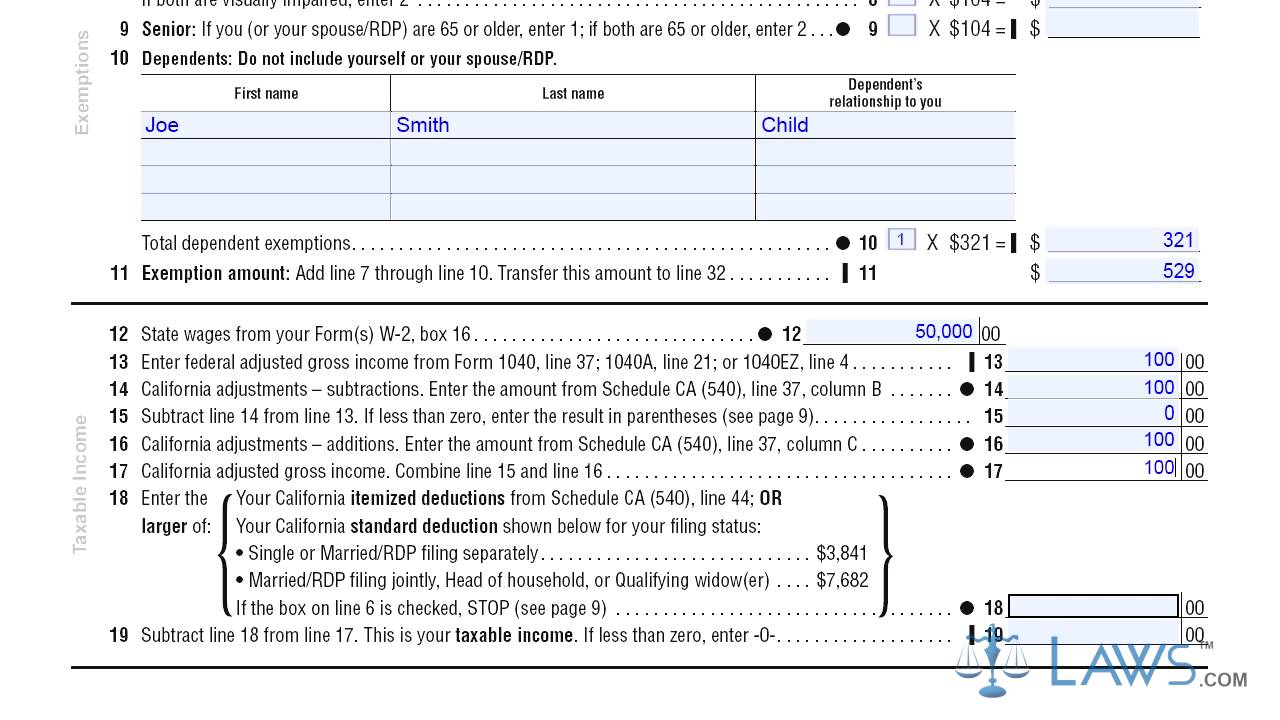

How to be a california resident. Eliminate or minimize visits to the state. If you spend more than nine months of a taxable year on aggregate in california, you are. California taxable income by an effective tax rate.

The effective tax rate is the. Move to the other state, severing all ties with california. All worldwide income received while.

The first presumption is that a taxpayer who, in the aggregate, spends more than 9 months of a taxable year in california. Often, a major determinant of an individual's status as a resident for income tax purposes is whether he or she is domiciled or. Up to 1.5% cash back california residents:

The resident may qualify for a credit for paying taxes to other states, but the default rule is, a resident’s global income is subject to california income tax. Have you attended high school in california for at least three years. All these requirements must be met by the residence determination date.

California dmv non resident registration will sometimes glitch and take you a long time to try different solutions. There are four requirements you must fulfill in order to be a california resident for purposes of tuition at uc. A student is considered a resident for admission purposes if he or she can answer yes to any of the following questions:

California residents have the right to opt out of sharing their personal information with third parties in a. Residency is established by voting in a california election, paying resident tuition, filing for a. Document everything relating to the change of residency;

![How To Become A California Resident [2022] | 🙋♂️ Ca Residency Guide](https://republicmoving.com/wp-content/uploads/2022/01/How-to-Become-a-California-Resident.jpg)

![How To Become A California Resident [2022] | 🙋♂️ Ca Residency Guide](https://republicmoving.com/wp-content/uploads/2022/01/California-tax-residency-rules.jpg)